Rocking the Boat at Boat Rocker Media

Minority Shareholders in Boat Rocker Deserve Better Terms on the Blue Ant RTO

I was driving to the Orlando airport early on the morning of March 24th when my phone lit up with a text from a friend and fellow small cap fund manager. He sent me a link to a press release from Boat Rocker Media, a company we had discussed a few months prior and in which I held shares. “Talk about confusing,” he wrote, “But awesome, a congrats is in order.” I pulled off at the next exit to investigate the news.

“Boat Rocker Media Signs Definitive Agreements for a Proposed Reverse Takeover by Blue Ant Media Concurrent with a Management Buyout of Boat Rocker’s Studio Business” announced the headline. “The agreed deal value of C$1.80 per Boat Rocker Media Inc. share represents a substantial premium…of approximately 125% to the March 21, 2025 closing price of BRMI’s shares…” continued the press release. Through a reverse takeover transaction, shareholders in Boat Rocker would come to instead own 26.5% of Blue Ant Media, a previously private Canadian media company controlled by Michael MacMillan. Fairfax, which owns about 42% of Boat Rocker, also holds 23% of Blue Ant and would provide various guarantees to support the deal (more on that below).

“I’m not sure whether congratulations or condolences are in order,” I replied to my friend. The C$1.80 per share value stated in the press release was based on the company’s view of the value of the pro-forma Blue Ant entity. The market opened with Boat Rocker stock above $1, but it quickly fell below $0.80. I raced through security at the airport and found a quiet area to dial-in for the 10 am call, hoping to have some questions answered. Unfortunately I was not permitted to ask questions on the call, nor was at least one other Boat Rocker investor who dialed in. The stock closed the day at $0.75, a massive discount to the $1.80 stated deal value. Evidently, investors trading in Boat Rocker stock that day had a much different view of Blue Ant’s value.

Background on Boat Rocker Media

Boat Rocker is a Canadian media company founded in 2003. The company went public in 2021 at the peak of the streaming content bubble at $9 per share. The stock fell as low as $0.60 earlier this year and was trading around $0.80 prior to the RTO announcement.

Boat Rocker owns four production studios that create scripted, unscripted and children’s television content. Popular shows include Orphan Black, Invasion, The Amazing Race Canada, and Dino Ranch. Earnings from the studios can vary significantly depending on the quantity and timing of demand for specific content and the success of that content. There was a large investment in new content by the streamers a few years ago as the industry sought to build scale by grabbing subscribers without regard for profitability. Over the past couple years this boom has turned to bust as all streamers, including Netflix and Disney, have shifted their focus to profitability. The Hollywood strikes in 2023 did not help. Boat Rocker’s adjusted EBITDA from the studios, including corporate costs, was $23 million in 2023 but fell to essentially break-even in 2024.

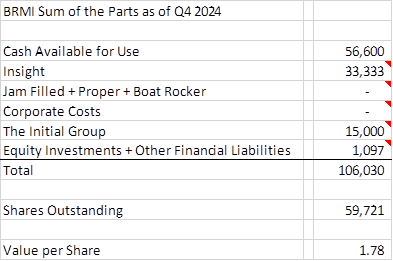

Aside from the studio business, Boat Rocker is an asset rich company. At the end of December, Boat Rocker had $56.6 million of what they call “cash available for use” which is cash not committed to productions (total cash was $86.5 million). Boat Rocker has about 60 million shares outstanding, so that is about $0.94 per share of free cash. BRMI also has an 8% stake in The Initial Group, a talent representation business, the majority of which was sold to TPG in June 2024. The remaining 8% stake is carried on the balance sheet at $11.9 million ($0.20 per share) and Fairfax agreed to buy Boat Rocker’s piece for $17 million in conjunction with the RTO ($0.28 per share). There are some minor equity investments and liabilities which net to a minor positive value of about $1 million.

Boat Rocker purchased a 30% minority interest in one of its four studios – Insight Productions – at the end of 2024 for $9 million cash and a note payable of $1.5 million. The transaction was executed as part of a put option arrangement and done at the fair market value of the shares. This implies a value in excess of $30 million for 100% of Insight, which Boat Rocker now owns.

The Proposed Blue Ant RTO

The deal is complex, so sharpen your pencils:

1. In exchange for their shares, Boat Rocker holders will receive 26.5% of Blue Ant.

2. The BRMI founders and CEO will privatize one of the four BRMI studios, called Boat Rocker Studios. They will get the studio along with $20 million in cash in exchange for an $18 million 6-year note payable owed to the pro-forma Blue Ant entity and guaranteed by Fairfax.

3. Blue Ant will assume the remaining three studios as well as the public listing and corporate overhead costs at BRMI. Blue Ant disclosed that the three studios generated $16 million of adjusted EBITDA in 2024 before corporate costs. Corporate costs were $24 million in 2024, but I suspect that figure likely includes some non-recurring amounts that are adjusted out of consolidated EBITDA. So I am guessing that Blue Ant is acquiring production assets plus corporate costs that were break-even +/- $5 million of adjusted EBITDA in 2024. This would imply Boat Rocker studios, which is being privatized by the founders and CEO, was probably around break-even without any allocation for corporate costs in 2024.

4. Fairfax is guaranteeing a minimum acquired cash balance to Blue Ant of $25.5 million, taking out the stake in The Initial Group for $17 million ($15 million after-tax), and providing a “value assurance payment” related to the performance of the acquired studios in 2025 of up to $35 million. The details of the value assurance payment are murky, but Blue Ant has presented it as if it will be paid and is to be counted as cash.

5. Blue Ant will seek to raise up to $60 million in an equity offering to fund M&A at what they see as an attractive point in the cycle. Fairfax has agreed to backstop up to $20 million of this offering.

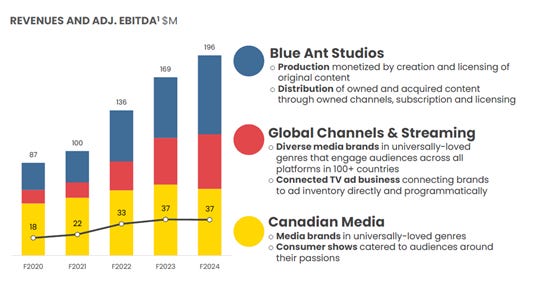

6. Blue Ant disclosed their historic financial results in the graph below, generating consistently positive adjusted EBITDA, including $37 million in 2023 and 2024. Blue Ant has net debt including leases of ~1x adjusted EBITDA prior to the RTO and this will shift to a net cash position of about $37 million following the RTO and excluding the proceeds from any equity raise.

7. There will be approximately 225.3 million shares of Blue Ant pro-forma and, if we assume the net of the acquired Boat Rocker studios and corporate costs was positive $5 million of adjusted EBITDA in 2024, pro-forma 2024 adjusted EBITDA would be $42 million. At $0.85 per BRMI share, we get a pro-forma enterprise value of $155 million putting the stock at 3.7x pro-forma adjusted EBITDA. This compares with small cap Canadian media peers Wildbrain, trading at 9-10x and Thunderbird, trading at 3-4x. The $1.80 stated value in the deal announcement implies a pro-forma trading multiple for Blue Ant of about 9x 2024 adjusted EBITDA.

Observations about the RTO

Fairfax as the largest shareholder in Boat Rocker at 42% and apparently the largest shareholder in Blue Ant at 23% did a lot to sweeten this deal for Blue Ant and the Boat Rocker founders and CEO. However, they seem to have forgotten about minority Boat Rocker shareholders who own 38% of the equity. Boat Rocker is basically a broken public company – way off the IPO price, small and illiquid float, low management credibility and experiencing a cyclical low point. Blue Ant appears to be a more profitable and better-managed media company looking to go public and raise capital, likely to offer liquidity to its shareholders, but also to execute M&A at a favourable point in the cycle. In a way, the marriage is logical and could replace the broken public company with one that is more functional.

With two sets of founders to please, Fairfax seemingly did a lot to get this deal done, providing various guarantees and additional capital. The Boat Rocker founders and CEO get Boat Rocker studios at a negative enterprise value. Blue Ant gets an asset rich company with various guarantees from Fairfax plus an additional $20 million of capital. But what do minority Boat Rocker shareholders get? They are exchanging their shares in an asset-rich but break-even (in 2024) media company for one that is more profitable but much less asset-rich. If we assume the drag from BRMI corporate is equal to the value of Jam Filled, Proper and Boat Rocker studios, I estimate BRMI stock is worth $1.80 just based on its assets and not assuming any improvement in results through a turn in the cycle or restructuring. But if we assume the studios net of corporate are able to earn the $23 million of adjusted EBITDA they did in 2023 and apply a 4x multiple, that would add about $1 per share, making Boat Rocker worth about $2.80.

The circular for this transaction has not yet been filed, so we don’t know what kind of process (if any) the Boat Rocker board conducted. We also don’t know what management is expecting for EBITDA over the next few years, though they did note with their Q4 results release that they expect 2025 results to weaken as compared with 2024. However, the murky Fairfax value assurance payment is based on a threshold of $19.5 million for the three acquired studios in 2025 which is up versus the $16 million generated in 2024, potentially contradicting that outlook.

There are also large working capital items that cloud the ability of outsiders to value the company. At year-end, Boat Rocker reported $120 million of production tax credits receivable ($2 per share), essentially amounts that Boat Rocker has earned from the Canadian government by producing content in the country. This is offset by $87 million of interim production financing, short-term loans that are secured by the production tax credits or revenue commitments from distributors. The content library, captured on the balance sheet at $90 million, also has value that may not be reflected in current earnings. Will, for example, Boat Rocker studios be privatized with a positive working capital balance in addition to the $20 million cash? Minority shareholders don’t know but management certainly does.

Blue Ant seems to be a more profitable and well-managed media company that is coming to the public market at a very inopportune time given the current volatility. Does the pro-forma entity deserve a 9-10x multiple in-line with Wildbrain or 3-4x in-line with Thunderbird? For now, the market in Boat Rocker stock has concluded the latter and unless that changes, I don’t see how minority shareholders can support this transaction. The deal will require majority approval of the 38% minority shareholders.

A Better Deal

Rather than the entirety of the consideration in Blue Ant stock, I would prefer some of the Boat Rocker cash that is headed to Blue Ant and the BRMI founders to come to shareholders in the form of a special dividend or cash consideration for the deal. How about $1.80 in cash instead of stock and, if not, some portion of the consideration in cash and the remainder in Blue Ant stock at a lower implied EBITDA multiple? It would also be helpful to know what management thinks of the go-it-alone course of action for Boat Rocker. Unfortunately, it is going to be difficult to trust anything management says at this point because they are incented to get this deal done and to paint the outlook as bleak for Boat Rocker. After all, they are acquiring a studio at a negative enterprise value and will receive the same consideration for their Boat Rocker stock as minority holders. That the interests of minority shareholders appear to be misaligned with management is especially troublesome given the opaque nature of this business, including the outlook for the lumpy studios but also the value inherent in working capital and the content library.

Could Boat Rocker not restructure, wait for a turn, and dividend out $0.50-$1 per share in cash in the meantime? Management implemented an NCIB in September last year when the stock was above $0.90, so they believed then that it was worth more than the $0.85 at which it closed on Friday.

I will be voting my shares against this transaction. Minority shareholders are not being compensated fairly for their stock as the deal is currently proposed. Give us more cash and so value certainty, tell us what the go-it-alone scenario looks like for Boat Rocker including whether it would be possible to dividend out $0.50-$1 per share from existing cash and a sale of the stake in The Initial Group, or convince other investors of the go-forward vision for the new Blue Ant so that my stock is bid up to $1.80 and I can realize the cash that way. With BRMI at $0.85, the market is saying this deal doesn’t work.

Talk about rocking the boat, am I right? This actually sux